Who do I vote for? A quick guide to the Federal Election

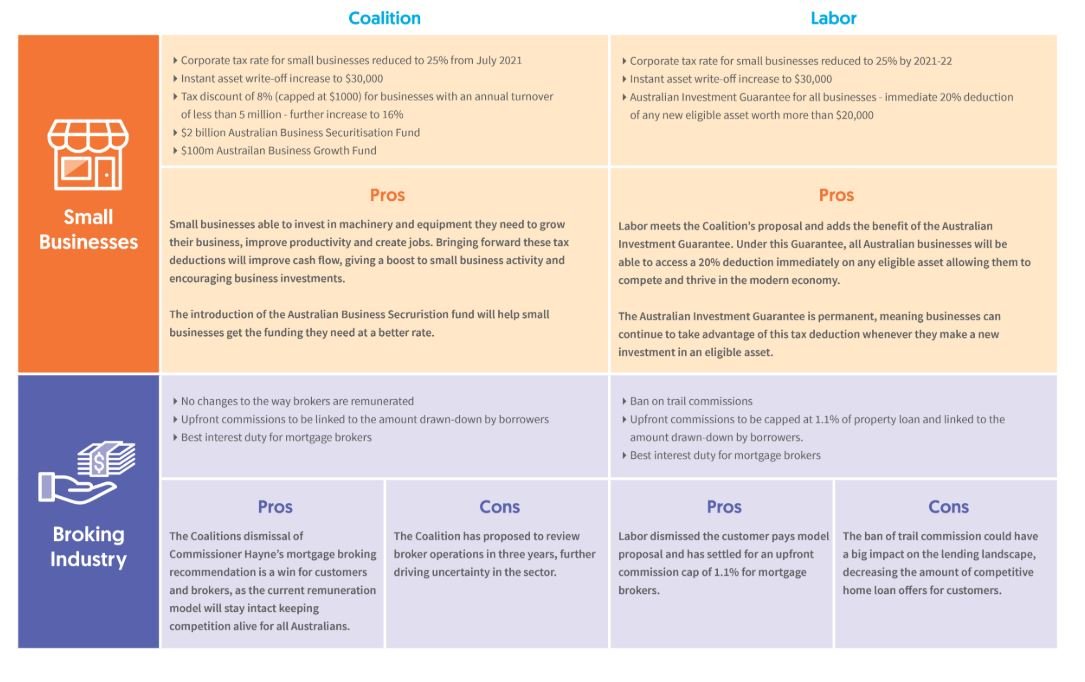

With the federal election fast approaching, there is one thing on everyone’s mind as we head to the polls on May 18... who do I vote for? With policy back-flips, leadership spills, impending tax breaks and tax increases, it’s almost impossible to get a clear idea of who is doing what, for who and when.

What about the financial services sector, will I still be able to get a loan?

No bank wants to be the first to get in trouble from regulators, so they have and will continue to impose stricter lending standards on home loan applications, making it harder for Aussies, like you, to access home loans.

The Coalition continues it’s fight with the big banks and financial misconduct, enhancing the responsibility and funding of industry regulators to better protect consumers.

Labor will tax the big banks and introduce a $160 million per year banking fairness fund and they will double the amount of financial advisors that are accessible for Aussies.

With the housing market declining - is now the time to invest?

Housing prices continue to drop across Australia, impacting homeowners, renters and investors. In the Coalition’s federal budget, there are no changes to negative gearing or the capital gains tax - two key incentives for property buyers.

But there is a gap. To improve property prices, we need more investors. Investors are key to the revival of the housing market, and the Coalition’s lack of incentive for Australian’s to get into the property market could further hurt house prices.

In its defense, the Coalition is pledging a $100 billion investment into transport infrastructure which will create new investment opportunities in areas with improved roads and public transport.

Now to Labor’s position on housing... Labor’s proposed changes will limit negative gearing to new investments only and will halve the capital gains tax discount. This is one of the hottest topics leading up to the election with Citibank Australia claiming that Labor’s policy could “accelerate the cyclical weaknesses in housing prices”, similar to what we saw when negative gearing was abolished in 1985. So, why the change?

Labor claims that the current arrangement benefits high-income earners and prevents first home buyers from entering the property market. Labor’s‘ plan for housing affordability’ will limit the tax breaks for investors, and drive investments away from established urban areas and into new housing developments. Some predict this will increase housing supply, and create more jobs in growing communities, while others predict a crash

As you can see, there are pros and cons for each policy from both political parties. Before heading to the polls on May 18, take extra time to weigh up your options and decide which policies will work best for you. It’s a big decision, but rest assured, we are all in the same boat!

Source - Loanmarket

by Matt Morley in Latest News

Archived Posts

- October 2024 (2)

- September 2024 (1)

- August 2024 (1)

- July 2024 (1)

- June 2024 (2)

- March 2024 (1)

- February 2024 (2)

- November 2023 (1)

- September 2023 (2)

- August 2023 (3)

- July 2023 (4)

- June 2023 (4)

- May 2023 (5)

- March 2023 (2)

- January 2023 (3)

- December 2022 (2)

- November 2022 (7)

- October 2022 (7)

- September 2022 (7)

- August 2022 (9)

- July 2022 (13)

- June 2022 (8)

- May 2022 (9)

- April 2022 (3)

- March 2022 (3)

- February 2022 (1)

- January 2022 (2)

- December 2021 (5)

- November 2021 (6)

- October 2021 (6)

- September 2021 (6)

- August 2021 (5)

- July 2021 (5)

- June 2021 (8)

- May 2021 (4)

- April 2021 (5)

- March 2021 (2)

- February 2021 (4)

- January 2021 (6)

- October 2020 (6)

- September 2020 (6)

- August 2020 (10)

- July 2020 (4)

- June 2020 (4)

- May 2020 (2)

- April 2020 (5)

- March 2020 (4)

- February 2020 (7)

- January 2020 (3)

- December 2019 (2)

- November 2019 (2)

- October 2019 (8)

- September 2019 (6)

- August 2019 (3)

- July 2019 (6)

- June 2019 (4)

- May 2019 (8)

- April 2019 (8)

- March 2019 (7)

- February 2019 (3)

- January 2019 (2)

- December 2018 (2)

- November 2018 (1)

- June 2018 (2)

- May 2018 (4)

- April 2018 (2)

- March 2018 (4)

- October 2017 (1)

- September 2017 (1)

- July 2017 (1)

- May 2017 (1)

- March 2017 (1)

- February 2017 (1)

- December 2016 (1)

- November 2016 (1)

- October 2016 (1)

- September 2016 (1)

- August 2016 (1)

- July 2016 (1)

- June 2016 (1)

- May 2016 (1)

- February 2016 (2)

- January 2016 (1)

- November 2015 (2)

- October 2015 (2)

- September 2015 (2)

- August 2015 (1)

- July 2015 (2)

- May 2015 (1)

- April 2015 (2)

- March 2015 (7)

- February 2015 (7)

- January 2015 (1)

- December 2014 (1)

- November 2014 (2)

- October 2014 (2)

- September 2014 (2)

- August 2014 (3)

- July 2014 (6)

- June 2014 (4)

- February 2014 (4)

- October 2013 (1)

- September 2013 (1)

- August 2013 (1)

- June 2013 (2)

- May 2013 (1)

- October 2012 (1)

- April 2012 (1)

- March 2012 (2)

- December 2011 (2)

- November 2011 (4)

- October 2011 (5)

- September 2011 (4)

- August 2011 (3)

- July 2011 (2)

- May 2011 (1)